#MATTHEW BANKS BANKS LAW GROUP SERIES#

Advises portfolio of life science/nanotech start-ups in all aspects of formation, Series A, B, and C rounds, spin-offs, licensing, governance, and on-going operations.Advised management team of commercial products manufacturing company in their management buyout and restructuring, and successful sale of non-core businesses.Advises portfolio of food and beverage ingredient manufacturing companies in their formation, capital raising, governance and business activities, including $6 million preferred stock investment in Ecuador-based beverage ingredient manufacturer.Manages and executes acquisition strategy for a $45 billion financial holding company, and provides ongoing representation for its acquired banks and affiliates.He served as damage control officer on the destroyer USS Stump (DD-978) and division officer aboard the battleship USS Iowa (BB-61).

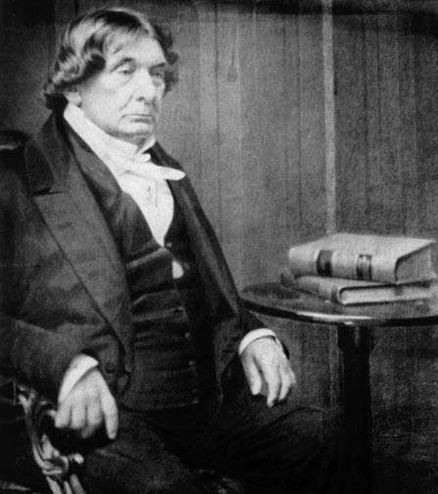

He serves as outside general counsel to several long-standing private company clients.Ĭlients value Matt’s direct but friendly manner, responsiveness, accountability for himself and his teams, and skills in executing a plan.īefore law school, Matt was a lieutenant in the United States Navy (1989-1993). Matt frequently partners with colleagues in our Private Clients group to build sustainable platforms for family owned businesses transitioning to the next generation of leaders. At the other end of the development spectrum, he helps entrepreneurs and startups see around the corners ahead by implementing good corporate design, built with efficient and cost-effective functionality. Since 2001 he has served as M&A counsel for a $35 billion financial holding company, negotiating more than 55 mergers and acquisitions of banks and bank holding companies, broker-dealer and asset management firms, mortgage banking and premium finance companies, and large commercial loan portfolios. More than a “deal lawyer,” he partners with clients, large or small, in planning and executing their growth strategies. Matt has extensive experience in mergers and acquisitions, restructurings, joint ventures, private offerings, private equity and venture capital investment, and other strategic transactions.

0 kommentar(er)

0 kommentar(er)